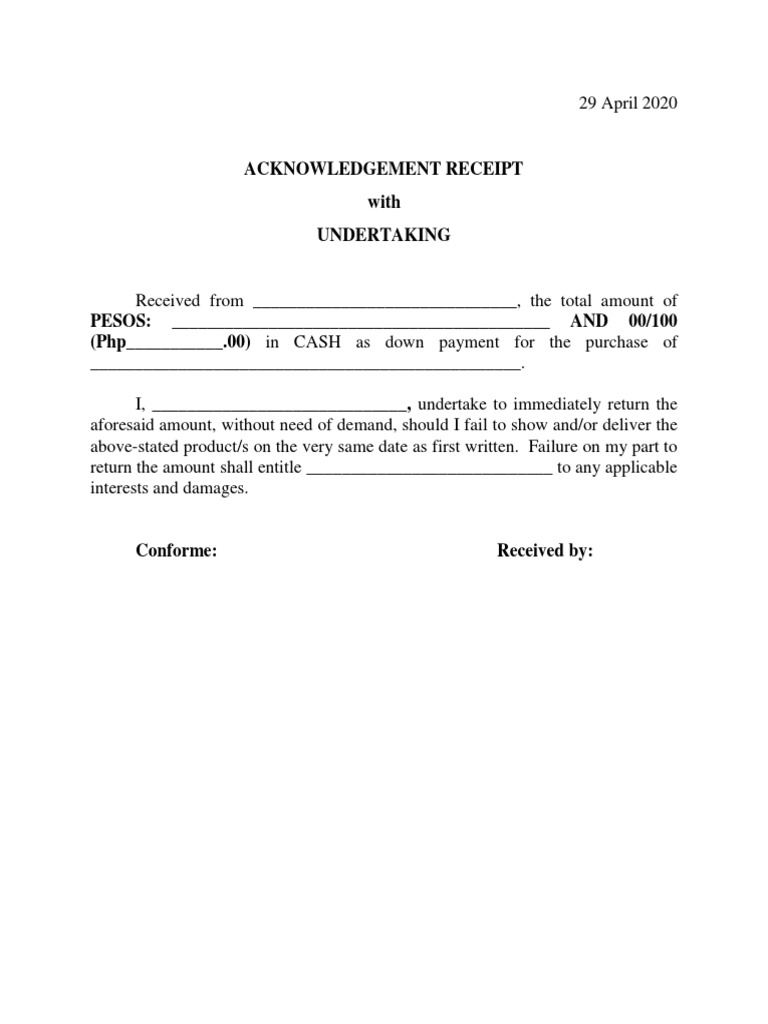

Prior to refinancing your vehicle loan, need make sure to check out their reasons for refinancing, the worth of your car or truck together with overall cost. Picture Borrowing: Shutterstock

Dubai: Increasing interest levels have remaining of numerous vehicles consumers trapped having huge finance and higher monthly premiums. But with rates of interest being decreased dramatically now – Utah installment loans and much more slices are on the brand new opinions, are you willing to might gain regarding refinancing your auto loan now?

Refinancing involves replacement no less than one existing financing with a brand new one, typically due to an alternate financial. However, did you know you will do an equivalent having a car loan?

Because the vehicle money is a sizeable amount of funds, after you’ve funded your car or truck, you could getting stuck and you will dedicated to the definition of of your car finance and you can commission. Yet not, this won’t have to be the case.

Car loan refinancing makes it possible to changes every element of your car financing – name, rates, costs, an such like. Nevertheless could come at a high price and you can prospective highest count about complete paid off desire for folks who offer the loan title.

However, which have cost dropping there’s a lot a whole lot more to take on than what’s happening that have interest rates toward main financial height.

Just before refinancing the car financing, you prefer make sure you look into your things about refinancing, the value of your car or truck and total cost, told me Ibrahim Riba, an elder car insurance and you can loan salesman based in Abu Dhabi. Here are some conditions you really need to envision before you could get started on it.

Why you should refinance my car financing?

step 1. You could have had a higher level initial and from now on your lender can offer a aggressive rates because prices enjoys come decreasing after the previous speed slash.

dos. We should shell out your vehicle off in the course of time, you should not spend interest or penalties to have early repayment.

step three. We would like to reduce your payment per month. For folks who increase your loan into an extended identity, you likely will get less monthly payment, particularly if you secure-in less rate of interest.

Though prices haven’t changed, boosting your credit rating may be adequate to rating a diminished price. The better your own credit, the greater amount of favourable financing conditions you’ll receive, extra Riba. If you’ve enhanced your credit rating because finalizing for your 1st mortgage, it is possible to be eligible for better mortgage terms and conditions.

Exactly what are the will set you back you really need to consider?

If you are contrasting various automobile re-finance has the benefit of, you should research outside the quoted rate additionally the prospective payment, explained Jacob Koshy, a great Dubai-dependent automotive industry expert, currently providing services in for the merchandising rates and just how interest levels could affect them.

Just before refinancing, think about if or not charges will perception your general discounts. Such as, your existing auto loan have an effective prepayment penalty in position. As well as assess the entire desire along side life of the borrowed funds.

Refinancing with the a longer term mortgage you may suggest their outstanding mortgage and you will percentage is higher than the value of your vehicle. Even if a bank get allow this that occurs, cure it. You don’t want to get into the right position where you have a tendency to need to lay extra cash directly into settle your vehicle loan when you have to sell.

Thus in a nutshell, while you are refinancing is a great means to fix offer your loan label, dont exceed what is practical to suit your vehicles worthy of.

What are the almost every other threats to consider?

In case the purpose of refinancing an auto loan should be to pay it well shorter, enable you to bank discover. They’ve been able to exercise a deal to you personally that is exactly like refinancing without the will cost you that is included with taking on a different sort of financing out of a separate financial, added Riba.