Nearly a quarter away from property owners state these are typically think big home improvements which season, and many of them methods may be qualified to receive a taxation deduction. This might assist reduce a number of the large will set you back regarding homeownership.

Listed here is an introduction https://paydayloanalabama.com/jackson/ to some examples away from tax-allowable home improvements. Of course, customers is always to consult a tax top-notch to understand more about who qualifies getting write-offs.

Energy-Efficient Upgrades

Residents could easily be eligible for an energy savings Do it yourself Borrowing all the way to $step three,200 to have times-successful advancements produced once was 31% off qualified expenditures, however it features certain constraints according to the brand of upgrade.

Energy efficient upgrades can help eradicate times incorporate and you may stress on good home’s critical possibilities. Updates include structural improvements toward domestic and also the installment of brand new assistance. Listed below are some attempt projects:

- A property times review is entitled to an income tax borrowing from the bank all the way to $150. An auditor will help your prospects learn in which they’re dropping times and you may identify safety and health products in their house. Property times review could help cut back so you’re able to 29% with the opportunity expenses, with respect to the Department of your time. To qualify for the financing, the newest audit must be used of the a professional household times auditor or a person who are administered because of the a qualified auditor. Additionally, it have to is a report wishing and you can finalized by the a professional domestic time auditor, and the declaration need to be consistent with world recommendations. Select details inside the Notice 2023-59 pdf .

- Arranged Time STAR’s Most efficient outside screen and skylights to have a great borrowing from the bank of up to $600 based upon eligibility. Replacement screen will help raise insulation and reduce the requirement to work on new Heating and cooling program.

- Created biomass stoves you to definitely see Time STAR’s conditions for a great $dos,000 borrowing from the bank. Biomass stoves need a good thermal performance score with a minimum of 75% to help you be considered, and you can will cost you start around work to put in. Biomass can consist of timber pellets and grasses. Even though consuming biomass decrease time need, insurance coverage it is strongly recommended following timber-burning guidelines in reducing flame or other health threats.

Brush Time Updates

Having fun with clean time may help lower reliance on traditional utilities and you will all the way down need and you will expense. Assistance such as solar energy panels are usually easy to maintain, generally simply demanding typical cleaning to stop dirt buildup. Below are a few test plans:

- Installing a solar hot water tank may help remove stress on an effective old-fashioned hot-water heater that assist prolong the life, according to the types of installed. Including, a-two-container solar power water heater preheats liquid earlier is located at a traditional water heater. Liquids temperature is generally next premier times debts in almost any family.

- Establishing geothermal temperatures pumps can help temperatures and you can cool property more proficiently than simply traditional heating and cooling solutions by the transferring temperatures towards the surface in lieu of promoting heat. They have a tendency to-be expensive, however, according to the Service of your time, it could possibly pick a profit toward investment getting homeowners into the four to help you 10 years based on readily available financial bonuses.

- Electric battery sites technology assists shop an excessive amount of time produced out-of brush energy sources. This provides a house a reliable power source if for example the grid decreases.

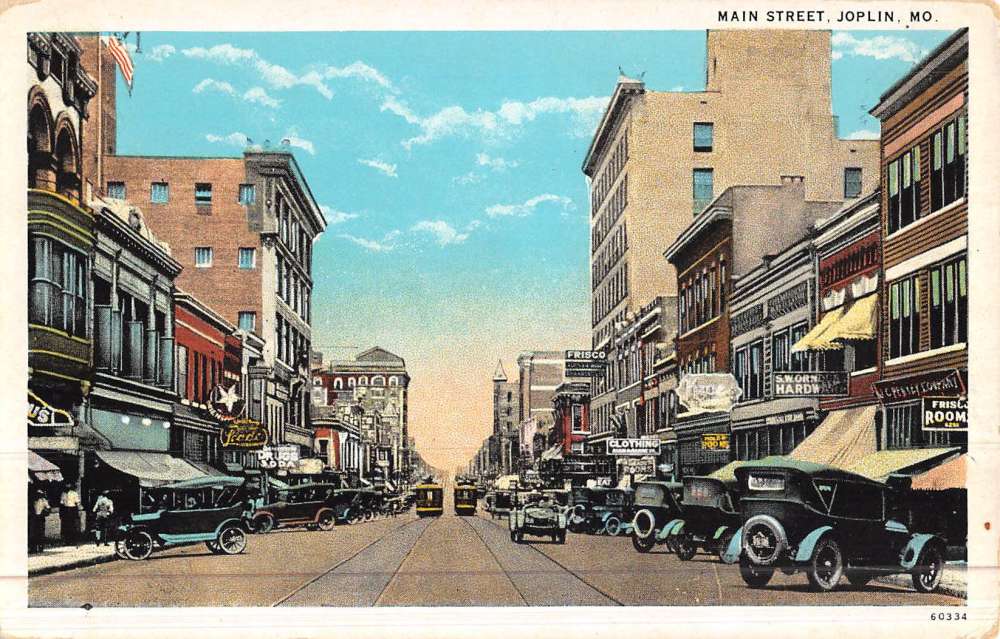

Historical Domestic Upgrades

This new Government Historic Rehabilitation Tax Credit you’ll apply in the event the people was in the process of a repair out of a historical domestic. Historical belongings can also be qualify for that it tax borrowing or any other offers because so many organizations need to preserve historic structures. Taking advantage of these may help decrease the financial load from possible repairs whenever you are helping to restore a beneficial residence’s fresh beauty. Here are a few shot tactics: