If you are looking accomplish home improvements in your existing family or if you are looking to pick a home that needs renovations, you’re needing financing. According to the dimensions and you can range of your restoration hopes and dreams, and you can whether or not you have to pay into pick off an alternative household in addition renovations, you have a few distinctive line of routes to look at.

Find out more about Home improvement Online calculator

Let us check a few more funding selection out of every one of these a couple pathways and you will mention simply how much your may be able to borrow doing your home restoration ideas.

How can you determine how much cash you ought to acquire to possess an effective house renovation?

If you’re looking to do home improvements on the existing house or if you are looking to buy a house that needs renovations, you will be needing that loan. According to the proportions and you can scope of one’s renovation aspirations, and you will even if you need to pay into pick out-of a different family in addition home improvements, you’ve got two distinct paths to adopt. The first path involves home financing and/or domestic equity. This type of renovation finance was linked with the home’s well worth and more than tend to needed which you use your house as the security in order to contain the loan. Next highway you can payday loan Indian Springs Village even think concerns funding solutions which aren’t tied to your residence. Should you decide towards to order a property that is in the demand for fixes, you might need certainly to automatically favor a loan alternative that boasts the expenses of the renovations into financial. The key reason for this would be the fact renovation loan choice one encompass a mortgage or that use your house since equity, most frequently include far lower interest rates than other actions away from funding. Yet not, for those who seriously want to keep the will cost you from remodeling your domestic independent from your own home loan, or if you don’t want to make use of home since the collateral so you’re able to secure the extra finance necessary for renovations, then you can buy the next roadway away from capital alternatives one to aren’t tied to your property. If or not you select the first otherwise next roadway from funding choice, the amount of money you could potentially obtain is going to rely with the particular funding while the lender. Why don’t we glance at a number of more investment options from all these a couple of pathways and discuss exactly how much you might be able to borrow to do your house renovation tactics.Financial investment options

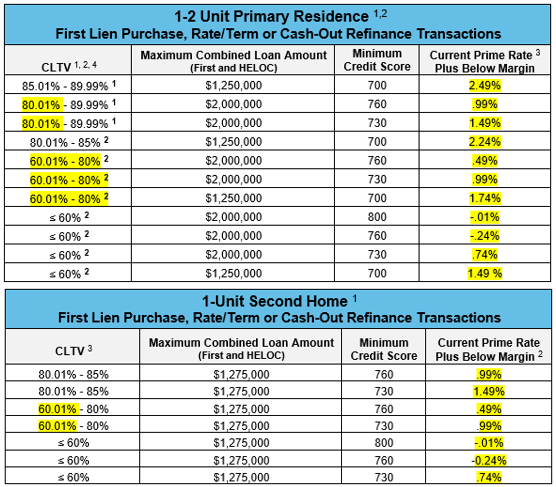

House equity financing and you will home equity personal lines of credit: When you yourself have no less than 20% equity accumulated into the house, you can consider a property guarantee financing otherwise a property guarantee personal line of credit to finance your recovery plans. When you use your own house’s security to obtain capital, you ounts on straight down rates than many other version of capital. How much cash as possible acquire of possibly a house guarantee financing otherwise an effective HELOC relies on the lender and you can the degree of security you really have of your property. According to the lender, you happen to be able to use as much as 80%, 85%, if not 90% of the equity you really have in your home.

Guarantee is largely the essential difference between brand new fair market price out of your house together with most recent harmony of the financial. Such as for example, in the event the house is already really worth $600,000 and you also nonetheless are obligated to pay $350,000 in your home loan, your household collateral was appreciated during the $250,000. Depending on the bank, then chances are you might possibly borrow doing 80% in order to 90% of that $250,000 providing you a potential restoration funds ranging from $two hundred,000 and you will $225,000. Again, you do not need to help you acquire the complete amount while probably shouldn’t fatigue the security in your domestic inside the an extra financial otherwise domestic security credit line.