The expense of PMI is additionally determined by the particular method of from PMI you take aside. There are two kind of PMI:

- Borrower-paid (BPMI)

- Lender-reduced (LPMI)

BPMI is the most straightforward. It is a monthly fee placed into your mortgage insurance rates that may go off when you reach 20% domestic security.

LPMI applications particularly PMI Advantage allow you to end a monthly home loan insurance policies percentage in return for spending a slightly high interest speed than just you’ll into the that loan instead LPMI.

Based business criteria at that time, you are able to spend less within the a couple decades by refinancing at the less price in the place of mortgage insurance rates just after you reach no less than 20% security of your house.

A variety out of LPMI enables you to buy area otherwise every of your PMI rules when you look at the a lump sum payment during the closure. If you make a partial fee, you’ll receive less interest which have LPMI. For many who pay for the complete policy, you’re getting a performance same as usually the one you’ll found if you weren’t paying LPMI, however it will be without any extra monthly payment of the BPMI, regardless of the size of the downpayment.

Instance of A made Costs

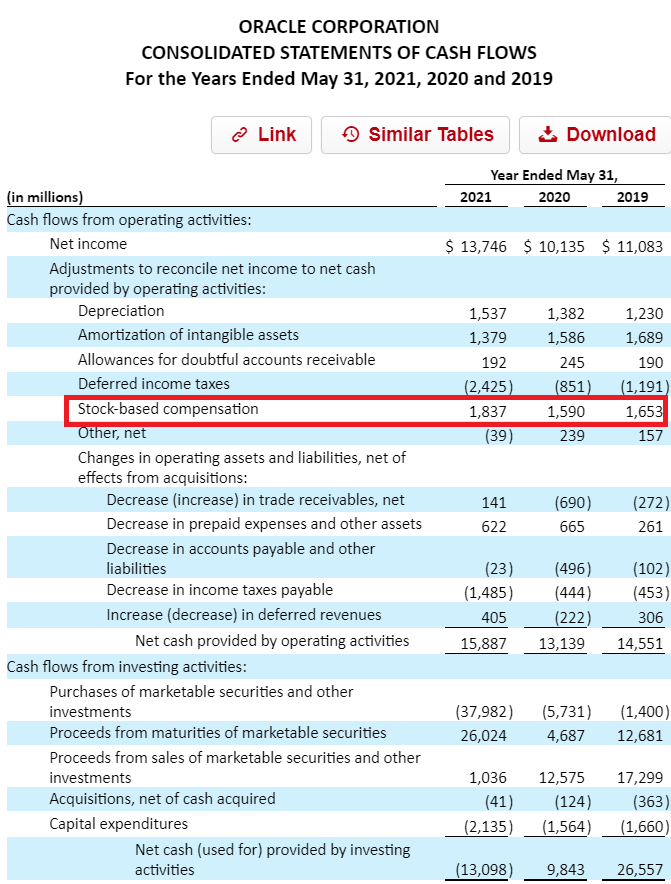

To convey a concept of simply how much you can expect to cover home loan insurance rates, why don’t we need an example away from significant home loan insurer MGIC. After you check out this chart, you are going to see some thing named LTV, an assessment of your an excellent financing balance to your residence worth. So it means loan-to-value ratio, and you can look at it since the inverse of your own down payment or collateral number. Such, the LTV could be 97% if you had a down-payment regarding 3%.

For it circumstance, let`s say their lending company has calculated you desire the maximum coverage level of thirty five% considering having a beneficial step three% down payment. After that, why don’t we together with suppose you’ve got a credit rating of 750. This is exactly a great $three hundred,one hundred thousand 30-year repaired-rates loan that have BPMI.

From the looking at the basic desk to the piece, we come across that BPMI rate for our circumstances is 0.7%. This means that the annual mortgage insurance coverage cost is 0.7% of one’s full amount borrowed. This really is divided in to monthly PMI payments which means your monthly costs is basically $175 ($300,100000 ? 0.007 equals $dos, = $175).

Its well worth detailing one to, though we’ve got depending this case on the public speed sheets, loan providers discuss the costs with home loan insurance providers. For this reason, the borrowed funds insurance policies pricing is obviously one thing to thought when comparing loan providers. Rocket Mortgage could possibly get a number of the low costs for sale in the for the website subscribers both for BPMI and you may LPMI. When you shop, PMI premium are various other section investigations.

H ow To cease Using PMI

PMI is a lot easier to eradicate than simply MIP and claims fees. Generally speaking, PMI is eligible getting termination as the LTV toward modern financing is 80% or smaller. By law, it ought to be removed given that home’s LTV is located at 78% in line with the modern percentage plan from the closing, depending on the occupancy and unit form of.

Automated Termination

In the event your house is one-family number one home otherwise 2nd domestic, their mortgage insurance rates will be canceled instantly within the following the scenarios (almost any happens basic):

- The brand new LTV at your residence is at 78%, for example you’ve received twenty-two% equity in your home based on the fresh amortization agenda (and also you did not generate even more costs to get it truth be told there).

- You are able to new midpoint of financial title (seasons fifteen for the a thirty-season financial, particularly).