Regarding outlying expanse of Maine, the newest USDA financing system plays a pivotal role inside the facilitating homeownership for those and group. As part of the USDA Rural Invention step, USDA fund provide accessible capital choices for those looking to get house when you look at the outlying and you can residential district aspects of Maine.

This type of funds, known as USDA lenders, appeal to lower- so you can reasonable-income some one and you can family members, planning to reinforce rural development if you find yourself taking affordable housing options. Ambitious residents when you look at the Maine can change so you can USDA finance because the good viable path for the recognizing their homeownership fantasies amidst the new quiet attraction of your own state’s outlying teams.

What is a beneficial USDA Mortgage?

A good USDA mortgage, called a rural Innovation Loan, was an authorities-backed home loan system built to assist reasonable- to help you average-money some body in the to shop for property from inside the rural portion. Especially in says such as for example Maine, where discover huge outlying terrain, USDA loans gamble a crucial role for the facilitating homeownership. This type of money are offered by All of us Agency out-of Farming (USDA) and you can aim to turn on rural development by providing affordable investment solutions which have positive words.

The application form serves individuals with small incomes just who can get no credit check personal loans in Maine endeavor so you can safer conventional mortgage loans. USDA funds render several benefits, in addition to lower otherwise no downpayment requirements, aggressive interest rates, and versatile borrowing from the bank guidelines. As well, they frequently use fixed-rate choices, making sure secure monthly obligations along side mortgage term.

In order to qualify for a beneficial USDA mortgage inside Maine, you ought to meet particular requirements from earnings limitations, assets location, and occupancy standards. Properties qualified to receive USDA funds need to be located in designated rural components, although these can include a variety of organizations.

Overall, USDA loans serve as an important product to advertise homeownership and you can monetary development in outlying nations, providing available money options for those trying to find a reduced income mortgage .

USDA Mortgage Requirements during the Maine

So you can be eligible for a beneficial USDA financing when you look at the Maine, several standard criteria must be satisfied. The house or property are ordered must be located in a designated rural area , given that influenced by the fresh USDA. These types of parts are generally outside cities and you may seek to render development in reduced heavily populated places.

Income eligibility is an additional very important foundation. USDA financing serve lower- to help you average-earnings anybody otherwise families, and you will certain income constraints differ considering things like family size and you will venue. Additionally, candidates need certainly to demonstrated U.S. citizenship, permanent home, otherwise non-citizen federal status.

The home financed by way of a good USDA loan should serve as your primary home and you can satisfy USDA standards of the updates and you may safety. These types of conditions means the foundation to possess being able to access USDA home loans during the Maine.

Pros and cons away from USDA Financing

Understanding the advantages and disadvantages away from USDA finance help you produce advised decisions regarding the money selection. The newest outlying advancement mortgage in Maine even offers an appealing option for those individuals looking to homeownership within the rural parts over the condition. Although not, as with what you, they also include their own band of positives and negatives.

Experts from USDA Loans

- Reduced to no downpayment : One of the most significant advantages of USDA finance is the choice to access financing with no money down , and come up with homeownership far more obtainable if you may not have nice deals.

- Improve re-finance : Maine residents with an existing USDA financing is also refinance in order to an excellent down rate (if readily available) with no appraisal, borrowing from the bank remark, otherwise income docs.

- Aggressive interest rates : USDA finance tend to feature competitive rates, possibly preserving borrowers currency across the longevity of the mortgage.

- Flexible borrowing from the bank conditions : Than the conventional loans, USDA finance typically have a whole lot more easy borrowing criteria, enabling individuals with smaller-than-prime credit records in order to qualify.

- Zero individual home loan insurance (PMI) : USDA financing do not require PMI, resulted in savings towards the monthly mortgage payments.

- Helps rural advancement : Of the assisting homeownership within the outlying components, USDA funds subscribe to the growth and you will balance of them communities.

Cons regarding USDA Fund

- Property qualifications : USDA fund are limited by functions for the appointed outlying components, that may maximum choices for potential house buyers.

- Income constraints : You can find money limitations for USDA money, definition people with higher incomes might not qualify.

- Make sure commission : If you’re USDA money normally none of them a deposit, they are doing possess an upfront and yearly be certain that fee set up to suffer this new USDA financing program to other borrowers. 2024 USDA financing make certain fees are step one% initial and you may .35% a year.

Being qualified having an excellent USDA outlying development financing when you look at the Maine comes to meeting certain bank standards along with the general qualification criteria detail by detail of the USDA. Coping with an educated lender can help you navigate the latest USDA loan conditions during the Maine while increasing your chances of loan approval. Listed below are some trick lender criteria:

Make an application for an excellent USDA Home loan from inside the Maine

When you find yourself USDA fund render positives such as for example zero advance payment and you may competitive rates, navigating the program processes is complex. For those for the Maine seeking to assistance with USDA loans and other financial alternatives, Griffin Money brings professional suggestions and you will customized selection. That have a connection so you’re able to customer satisfaction and you can a wealth of experience from the mortgage globe, Griffin Financial support try serious about helping you reach your homeownership desires.

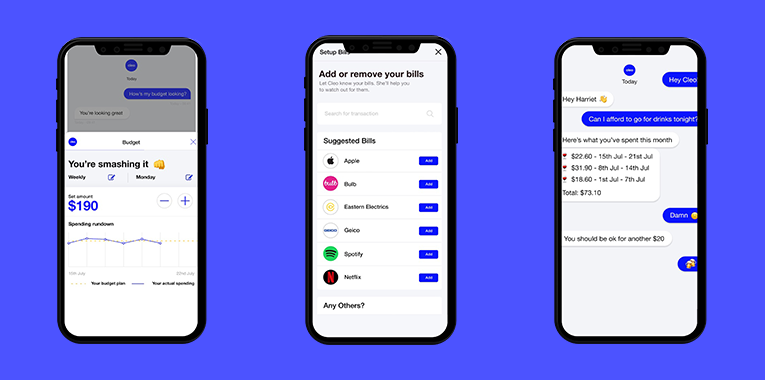

As well, install brand new Griffin Silver app getting much easier usage of financial systems and you can tips on the move. Regardless if you are examining USDA fund and other resource choices, Griffin Money is here to support your every step of the way. Reach today to get the full story or start because of the answering away an on-line application to possess good USDA outlying invention financing inside Maine.