Inheriting a loved your house or apartment with an other financial attached can cause problems to have heirs. They may deal with calls, series efforts, as well as property foreclosure on their recently-passed down possessions. Learn the choices to care for opposite financial harm to heirs, and how you can stop your household members of trying out your debt when you perish.

What exactly is a reverse Financial?

A face-to-face financial try a secured mortgage facing a house otherwise most other real estate you possess. Often referred to as an effective Domestic Guarantee Conversion process Home loan (HECM), it make it more mature people to make use of the new security in their house. There are not any monthly mortgage repayments, however, banks in North Carolina that offers personal loans online since you discovered additional money from the financial, the bill of one’s contrary mortgage increases and you may adds up interest as the much time whilst remains outstanding. You might pay down you to harmony at any time. Otherwise, it will become owed and owing when you offer otherwise permanently move from your home.

Whether or not a property manager borrowed $step one,000 getting family fixes otherwise $30,000 for scientific expenses, the whole harmony comes due abreast of the brand new loss of the newest debtor and you may one qualified low-borrowing from the bank companion. If the last term owner becomes deceased, the heirs to this possessions will have a due and you may payable find regarding financial and this means a full equilibrium of your reverse financial that must be reduced. Practically talking, it find will likely be provided following the Observe in order to Loan providers are written by the new estate’s private associate, or when someone in your family members notifies the financial institution your home owner has died.

Reverse Home loan Harm to Heirs

An other financial can make injury to heirs exactly who inherit this new property. It is because the whole balance appear owed at the same time. New You.S. Institution out-of Casing and you will Urban Creativity (HUD) direction to own HECMs says one loan providers will be you will need to resolve the newest mortgage inside 6 months of your borrower’s demise.

This time should be an issue when the you will find delays from inside the this new Fl probate techniques. Commonly, heirs should manage the private member additionally the loan providers when you’re probate continues to be constant when they need to remain the home. Failing continually to timely address an other home loan can mean the home have a tendency to face foreclosure up until the heirs has actually a chance to sell they to have full value, or see funding to pay off the debt. However, heirs who will be actively attempting to handle your debt (by the checklist the house or property offered otherwise trying money) can also be demand to two ninety-day extensions that have HUD acceptance, although the latest foreclosure legal proceeding was ongoing.

At exactly the same time, before the opposite home loan was repaid, it can cause the property for good clouded term. This will make it more difficult to market the home since the visitors and you may label organization requires assures that obligations commonly feel paid in the course of closure.

Alternatives for Dealing with Contrary Mortgage Heredity

When you are the proprietor given an opposite financial, you have got options to stop passageway your financial situation to another age group.

Keeping the balance Due Lower

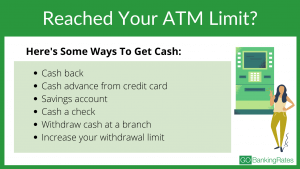

You can repay your own personal line of credit or contrary home loan equilibrium through your lifetime. You could potentially however make use of the security of your home when you need it, but by paying along the equilibrium over the years, you retain their heirs regarding up against reverse mortgage problems once your own death.

House Going to Pay-off Mortgages

Property owners also can booked funds in their property. Essentially, mortgage loans do not need to be paid regarding within someone’s house. But not, their Usually is also lead your executor to repay the opposite home loan included in the home government procedure using earmarked loans, or your residual house. This will clear new term introduced to your heirs and steer clear of the lending company out-of future once these to collect the debt.

Placing Reverse Mortgage Attributes during the Trusts

When you are upgrading their home believe, you can transfer a house that have a face-to-face mortgage towards the a good life revocable trust. This can take the burden regarding make payment on balance regarding the friends. Alternatively, it would be up to your trustee to make use of almost every other property on your own house to settle the borrowed funds lender’s claims and you can manage your debt.

Heirs which located properties encumbered which have contrary mortgage loans enjoys selections of their. Essentially, heirs will get 1 month immediately after receiving the due and you can payable notice from the lender to choose whether or not to:

Support the Possessions and you will Afford the Reverse Mortgage

Heirs can pick to imagine the reverse financial and you will spend it out-of. You will be in a position to re-finance having fun with a traditional home loan and repay the reverse mortgage like that. It all depends toward fair value of the house or property, the balance of your contrary mortgage, as well as your personal credit score.

Offer the house and keep the internet Collateral

You will possibly not you need or want to keep up with the domestic your inherited. If that’s the case, the most suitable choice is to promote this new inherited property and you can utilize the continues of the income to generally meet the reverse financial. You’re entitled to one online equity regarding the possessions, that may bring about a hefty resource get and you can related fees, therefore do not forget your discuss the taxation implications with the house administration lawyer otherwise an accountant prior to taking this 1.

Leave on Assets otherwise Stop trying They towards the Lender

In case your family has lost well worth, the balance of your opposite financial is very high, or you cannot afford other options, you can should just leave on the possessions. Not as much as government laws, heirs whom inherit assets with contrary mortgages are merely responsible for small of one’s complete mortgage equilibrium or 95% of your own house’s appraised worth, any sort of is actually quicker. From the surrendering the home toward lender otherwise allowing property foreclosure proceedings that occurs, you could potentially match the financial obligation and you can take care of any collection work against your. It indicates walking of an other mortgage issue is both how you can prevent spending your liked your debts.