Even although you has actually a shaky credit rating or limited dollars supplies, our Home loan Teachers are working locate an easily affordable investment option that fits your circumstances.

What’s even better? Given that an excellent USDA approved financial during the Tennessee 1 , Dashboard makes it possible to safe a zero-money-off USDA financing with an aggressive Apr.

Contents

- What is a good USDA Financing?

- USDA Financing Qualifications into the Tennessee

- Gurus https://elitecashadvance.com/payday-loans-il/hamilton/ & Disadvantages from a good USDA Financing

- USDA Mortgage Standards

- How-to Apply for an excellent USDA Financing

- USDA vs. FHA Loans

- TN USDA Home loan Frequently asked questions

What exactly is a good USDA Mortgage?

A good USDA financial try a residential mortgage during the Tennessee protected by the U.S. Department regarding Agriculture. USDA financing can handle lowest- so you can reasonable-income family members whom might not otherwise qualify for antique home loan financial support.

USDA loans emerged from inside the 1991 included in the Unmarried Household members Construction Secured Financing system, an initiative you to definitely wanted so you’re able to incentivize the development of outlying, low-thickness parts. The application is actually a greatest alternative one of cash-secured borrowers that have faster-than-perfect credit.

Exactly why are USDA mortgages popular? Because unlike conventional finance during the Tennessee, which generally require a down payment off 20% or even more, USDA funds do not require any cash down. Yup, that’s right. Zilch. Zip. Nada. Of course, you can still be expected to pay closing costs also verify charges. Such charges are like personal mortgage insurance policies, or PMI, and you will manage the lending company when it comes to standard.

USDA Loan Qualifications when you look at the Tennessee

We become they zero-money-down 2 a mortgage sounds very. Before you start hootin’ and hollerin’, you will want to make sure that you are qualified.

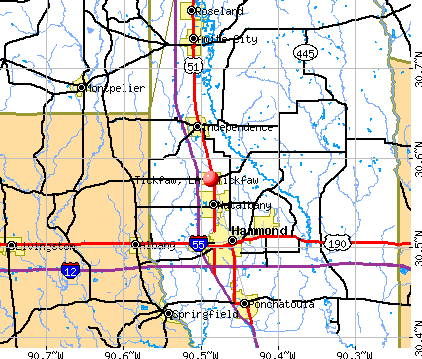

To be eligible for a beneficial Tennessee USDA loan, you truly must be to buy a property inside the a rural town. New You.S. Institution regarding Farming defines rural given that people town that have fewer than 20,000 people. Uncertain in case your several-bedroom bungalow when you look at the the downtown area Maryville is up to snuff?

USDA Money inside the TN: Eligibility Elements

The good news is, there are many gorgeous urban centers from the Volunteer Claim that are believed outlying from the You.S. Service out-of Agriculture. If you would like buy a slice off Sevierville or Elizabethton, upcoming yeehaw! These types of metropolises is actually quick, unusual, and then have communities better below 20,000. However, if you may be a location slicker set on living in Chattanooga or Knoxville, you’ve probably some difficulties selecting good USDA qualified property.

Almost every other USDA Loan Qualification Requirements

So you can safer a USDA loan, you ought to see specific income restrictions. In Tennessee, you cannot buying over fifteen% over their area’s average money. The specific number relies on hence condition you reside however, averages $91,900 to own children away from five and you can $121,three hundred for families of four or maybe more.

Tennessee USDA mortgage eligibility is also impacted by your credit rating. To help you meet the requirements, need no less than good 640 and a personal debt-to-income proportion out-of 41 percent or faster. A steady a position background enables you to a aggressive candidate as the really. Strive for at least half a year within one gig, even when expanded is the best.

Just starting to be a little nervous about your creditworthiness? Take a good deep breath and present us a shout. We’ll hook your that have an expert Financial Mentor who will comment your financial advice to see if your qualify for a beneficial Tennessee USDA mortgage. If not? They will certainly explore the dozen most other financing selection we offer and acquire something that caters to your circumstances.

Professionals & Disadvantages of USDA Money

Is the country contacting your title? In that case, good USDA home loan might possibly be ideal for you. Anyway, Tennessee USDA financing are meant to incentivize way of living out in the latest boondocks. However, this funding product is even made to create homeownership much more attainable getting household that simply don’t have a king’s ransom to free. Together with, which lending program has the benefit of aggressive loan words.