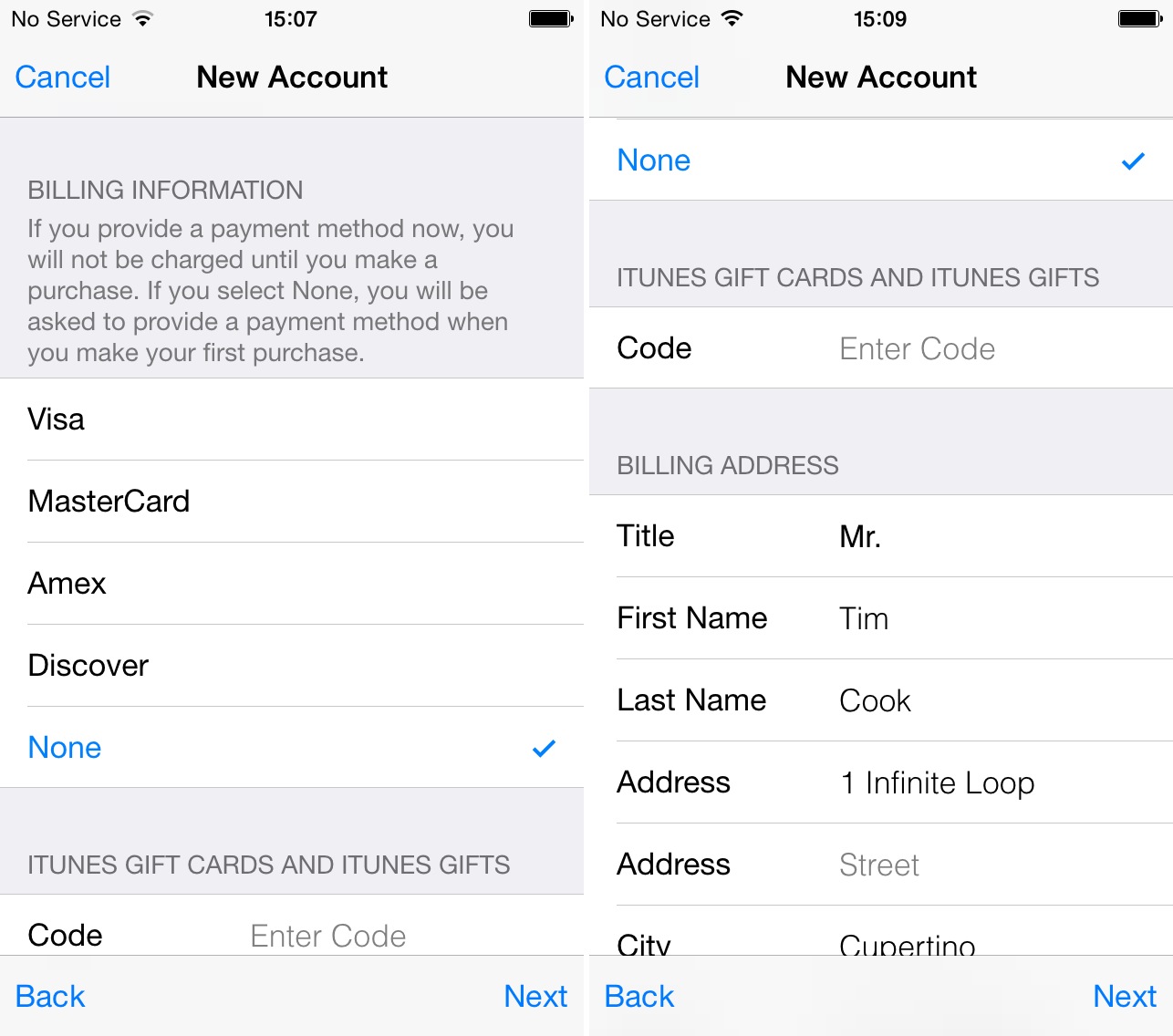

Commercially, you are able to use a cash loan away from a credit card (or several playing cards) to order a residential property.

Mastercard rates was more than other sorts of money spent loans or loans from banks. The credit ratings might suffer in case your credit reports tell you a high balance-to-maximum ratio in your private credit card membership(s).

Just like the an alternative rather than making use of your private playing cards, business playing cards can help you create providers borrowing – including provide an available way to obtain borrowed resource. You can utilize a great 0% Apr business charge card to finance repairs to the a remedy and you may flip, including, up coming (hopefully) sell or re-finance the property before the introduction speed expires. Because so many company playing cards never are accountable to personal credit (unless you default), you will be able to perform this with just minimal to help you no perception toward credit ratings otherwise the debt-to-income proportion (DTI).

Self-led IRA

With a personal-directed IRA, you’ve got the substitute for payday loans Aetna Estates commit past typical holds, bonds, and mutual fund. This type of option expenditures you’ll become gold and silver coins, organizations, and you will a residential property.

To make use of this procedure, start with starting an IRA which have a caretaker you to definitely attributes thinking-directed levels. Rather, you might discover a great checkbook IRA account and you can would this new financing, record-keeping, and Internal revenue service revealing conditions oneself. Regardless, you will want to find out the regulations and you can comprehend the dangers in the event the you will use this approach to order real estate.

401(k)

A great 401(k) normally a tax-amicable method for saving to possess later years. Usually, you can’t invest in a residential property directly from your own 401(k) account. You could potentially, however, roll over their 401(k)-tax-free-towards a self-led IRA account. After the rollover, you can make use of the money purchasing home, and industrial a house.

But cashing aside a giant part of the 401(k) having a real estate investment possibility is actually a threat. You could potentially cure the money your invested when the something make a mistake. You may also feel at the mercy of taxes and a young detachment punishment if you fail to pay off your 401(k) financing.

At the mercy of fund

When taking on what is named a good at the mercy of loan, it indicates you’re taking more mortgage repayments into seller’s current mortgage. The home you will be to find are susceptible to the loan that’s currently set up. However, you’re not and in case the mortgage itself.

There might be a difference between your full cost the newest vendor try asking while the loan amount. In this instance, you will need to afford the merchant the difference in bucks, take out more investment, otherwise negotiate a supplier funding contract.

In some implies, a great at the mercy of financing represents shorter risk to you personally. Should your property goes into property foreclosure, for example, your own personal borrowing from the bank you can expect to refrain intact. As well, in case the financial finds out you generated an arrangement as opposed to the permission, it may phone call the mortgage due. At that point, you would both need to find alternate resource otherwise risk losing any finance your dedicated to the home.

If you’re considering an investment property mortgage, see what the financial institution you intend to partner with requires inside terms of qualification.

Most likely, one another yours and you will organization credit scores would be considered to determine the creditworthiness, and your obligations-to-earnings ratio. How long you have been in business also can count to help you mortgage lenders.

Could it possibly be More difficult to find a mortgage for a residential property Than simply property?

It depends. When you have receive an effective assets and also have a good down-payment, it may be better to here is another loans than simply it will be to obtain a home loan.