Brand new unmarried-wider MH should be based in an outlying region of you to stand a chance for being qualified for a USDA-recognized loan. Anticipate loan providers to possess different even more criteria to your financial.

- Creditworthiness (you have a number out-of paying down finance otherwise bills)

Create USDA Money Wanted PMI?

USDA funds don’t need private home loan insurance policies, the standard having old-fashioned mortgage loans. However, they desire installment long rerm loans no credit check Jacksonville NY a couple of resource charges that will be quite similar to PMI.

Expect to pay an initial be certain that percentage of 1 % of the financial count. Additionally spend an annual percentage off 0.thirty-five percent of your overall amount borrowed.

USDA-accepted loan providers always roll out brand new initial percentage in the loan matter and you may predict you to definitely spend it during the closure.

However they charge the brand new annual payment immediately following on a yearly basis and you may divide it on the monthly premiums that you ought to spend along with other month-to-month loan obligations.

Even in the event one another upfront and you may annual charges is actually recharged regardless of the advance payment you will be making, he is way less expensive than individual financial insurance.

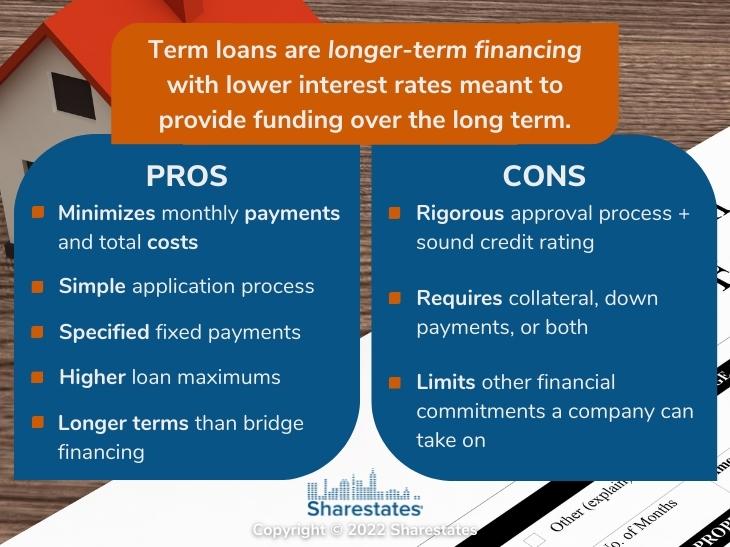

You could believe a conventional mortgage to invest in the purchase of an individual-greater MH because it has beneficial loan terms and you can interest rates. Which mortgage can also be suit your money demands for those who have an excellent credit rating and you will a decreased personal debt-to-income proportion.

Kind of Conventional Fund to have MH

The typical types of traditional funds are conforming old-fashioned money, non-compliant conventional funds, fixed-rate antique funds, and you can changeable-rate old-fashioned fund.

A conforming conventional financing is commonly less than or equivalent to an FHFA (Federal Houses Money Company) -acknowledged financing limit.

The FHFA kits this maximum annually in order to reflect maximum loan amount Freddie Mac computer or Federal national mortgage association can find. Lenders make use of credit score and you can mortgage fees capability to meet the requirements your to the mortgage.

Non-compliant old-fashioned loans always go beyond this new FHFA conforming limitation. They are used buying a house with a high cost versus compliant maximum.

Yet not, anticipate to stumble on tight underwriting principles predicated on cash supplies, down-payment, and you will credit history needed for recognition by the loan providers.

Fixed-speed antique financing have a predetermined interest, while variable-speed mortgages (ARMs) keeps rates that change over go out. Sleeve pricing are often based on the current market rates.

Qualifying to possess a normal Mortgage

Good credit and you can down-payment would be the ideal criteria for conventional money if you’d like to get one-wide MH. Once the old-fashioned finance aren’t protected otherwise insured by the federal regulators, expect more strict qualification conditions.

Individual mortgage lenders have the liberty so you can enforce stricter requirements than simply advice passed by Freddie Mac, Federal national mortgage association, and you may FHFA.

Hence, you may find it difficult to be considered whenever making an application for an excellent loan immediately following personal bankruptcy or foreclosures. The latest eligibility criteria are the following:

Good credit Score

A credit score regarding 740 or maybe more normally entitle you to reduce costs and attractive interest levels. The lending company makes an arduous query to examine their borrowing from the bank prior to giving you with the mortgage.

Lower Personal debt-to-Earnings Ratio

Extremely private mortgage lenders expect that provides a financial obligation-to-income proportion (DTI) below thirty-six percent when applying for a traditional financing.

The DTI shows the quantity of money you will be due as personal debt separated by your month-to-month income (ahead of taxation). Consider utilizing a personal debt-to-earnings calculator in order to guess their DTI in advance of trying to an enthusiastic MH loan.

As much as 20 percent Down payment

A low deposit you can previously purchase a traditional MH mortgage was step three per cent. not, you have to pay much more for those who have a premier debt-to-earnings ratio and lower credit rating.