All of our participants, Patty and you can Bryan, put their residence’s security to alter its dated family toward a great room good for their big family unit members. They decided, why get someone else’s dream domestic when they you may remodel their individual? With a bit of assistance from us, it used a house security financing to take their home so you can their complete possible-and inspire-the outcomes talk into on their own.

*Annual percentage rate = Annual percentage rate within 80% loan to help you worthy of. Cost active ount out-of $5, required. $5, for the the fresh money is expected when refinancing a current Participants initially Domestic Collateral Financing. Sample terminology: For many who acquire $31,one hundred thousand from the cuatro.99% Annual percentage rate to possess an effective ten-season label, the estimated monthly payment is $. If you obtain $30,100000 in the 5.74% Annual percentage rate having a 15-12 months term, your estimated payment per month is $. Rates are derived from creditworthiness along with your home’s mortgage-to-well worth. No. 1 house just. Possessions insurance is called for. Pennsylvania and Maryland homes only. To possess low-participants, you are needed to sign up Participants very first to meet up with eligibility conditions.

**100% investment exists on an effective priple terms: For folks who borrow $31,100000 during the % Annual percentage rate to own a 20-seasons term, their projected payment per month tends to be $. Almost every other constraints or requirements can get implement. Cost is actually subject to transform without warning. Speak to your tax coach having taxation deduction advice.

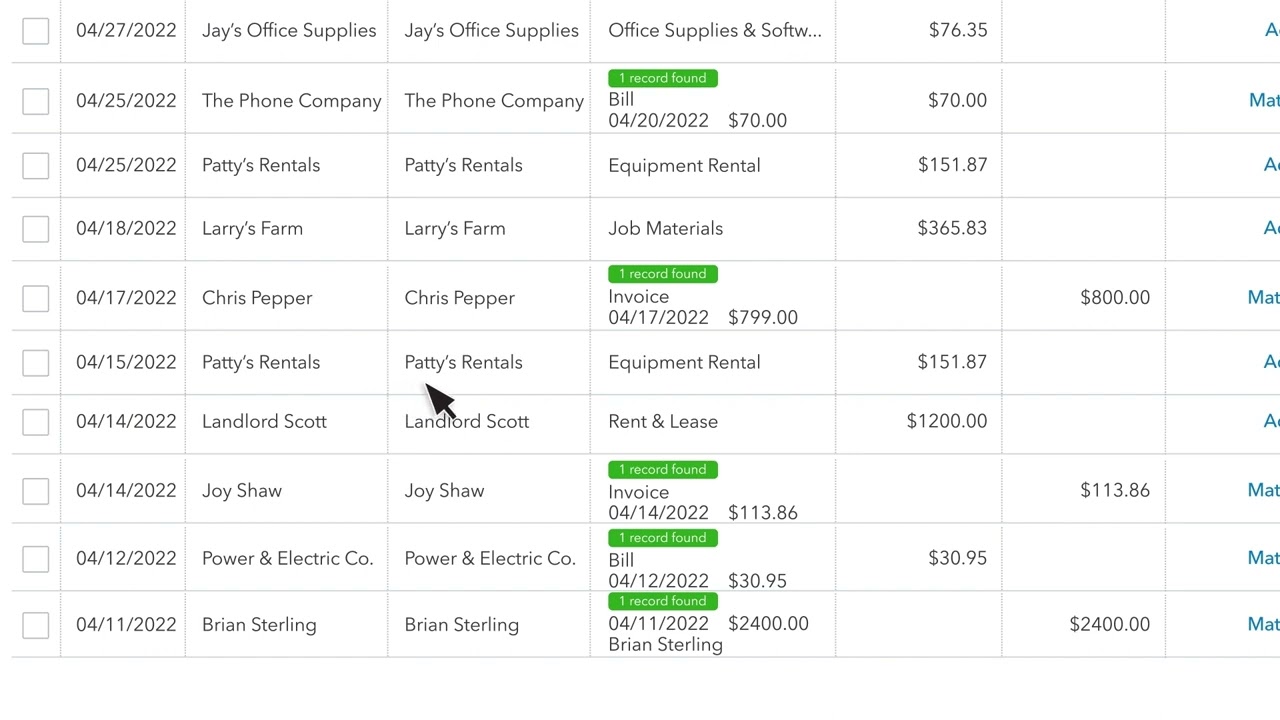

Pre-Family Collateral Financing

Which have recently ordered their brand new family, Patty and you will Bryan knew that it would need certain work to it really is getting «theirs.» Into the main lifestyle portion including the home, kitchen and you may living area are dated, the couple decided to score a property guarantee mortgage around to cover some big updates.

The major Inform you

Patty and you will Bryan put their property guarantee mortgage provide the family quite the latest conversion process! Improvements to their family room, cooking area and you will dining room have made a life threatening influence on the new capability of its family for the whole relatives. They now have the best collecting spot to build recollections to own many years payday loans Milliken to come.

You will want to you?

As Patty and you can Bryan’s facts suggests, borrowing from the bank contrary to the guarantee of your house is a significant decision. But do not care and attention-we’ll feel with you each step of one’s means.

Let’s Look for What is You can

Domestic collateral loans can be used for one thing besides renovations, too. Use your house’s worthy of to pay for college or university costs, another type of automobile, unexpected debts and a lot more. Having mortgage cost nevertheless close historical lows, we can make it easier to use as much as 100% of house’s really worth, which have conditions up to twenty years.** Done the application on the internet, and a part have been around in reach to talk about the borrowing options and you may agenda an appraisal to decide the appropriate qualifying words.

House Fantasy Domestic

Buying your fantasy residence is those types of larger lives goals which you conserve getting and you will think of. Having Patty and Bryan, its dream home ended up being you to definitely with a tad bit more profile than just they’d to start with expected. Manufactured in the new mid-eighties, they saw their house because an investment and you will desired to promote it a small deal with-elevator so they really you can expect to bring it so you can their complete possible. To do this, it know they will you desire some let financially, so they turned to you for almost all assistance. Click on this link to read through the complete story.

Discuss the number of choices

Having fun with domestic guarantee and then make renovations can come with high tax advantages. As the home security financing render all the way down rates than of numerous beginner loans and you can handmade cards, they are a simple way to pay for a college education, money a wedding otherwise combine higher-interest personal debt.

Member Worthy of Shelter

When you submit an application for your house Security Repaired Speed mortgage, you might choose put Associate Value Safeguards (MVP). That it visibility usually cancel your own monthly obligations in case of passing, handicap, or involuntary jobless-instead penalty, additional appeal, or dings on the credit report.

Uncertain? Let’s Speak.

Borrowing from the bank contrary to the guarantee of your house is a significant decision. But do not fret-we’re going to end up being with you each step of method. Incorporate on the internet and we shall contact talk about the choices.