You been the process to buying a property. You came across their bank as well as have become preapproved. You’ve chose a house plus the seller provides recognized your own give. You happen to be well on your way to residing your brand new domestic around can not be additional difficulties, best?

Commonly, this is exactly real. Yet not, when economic situations changes amongst the date youre pre-accepted for a financial loan in addition to go out you technically romantic on the the loan, the road to buying property will be slowed otherwise totally derailed. That is why it’s important to ensure that there are no big transform toward profit during this period.

Prevent Applying for Almost every other Money

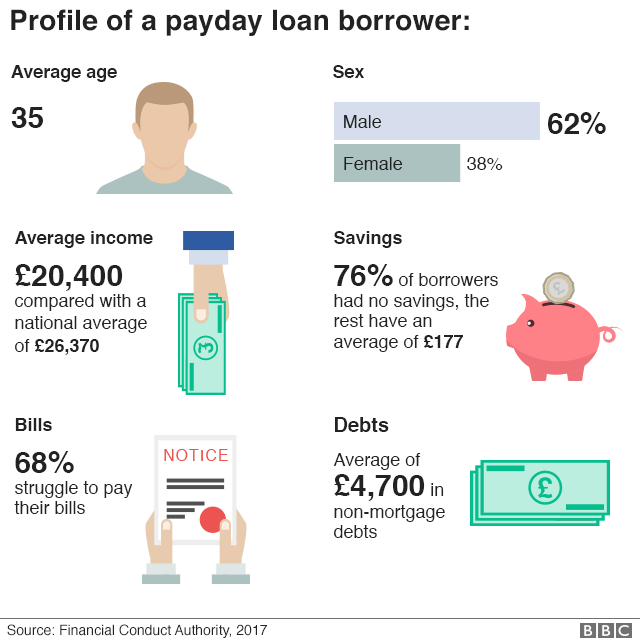

You will want to avoid applying for most other fund (together with payday loans), beginning another type of personal line of credit (particularly a credit card), if not cosigning with the financing. A few of these points arise on your own credit file. Your bank may find the rise in debt and needed monthly costs. They could dictate that capability to make repayments on your own modern home mortgage consult has changed.

The aforementioned issues often affect your credit rating. However they need someone to focus on a credit assessment on you, and this action itself can even connect with your credit rating. Because your credit history find your own home loan price or you qualify for a financial loan, you need to cut this type of transform to have later on.

End Late Payments

This can both change your credit rating and supply important evidence toward bank that you can and come up with money. Imagine and come up with automatic costs.

Avoid To invest in Huge-Pass Issues.

You will want to prevent steps that’ll rather e. It means would love to get larger-solution points such as for instance an auto, ship, otherwise furniture up until once you’ve entirely finalized in your financial mortgage.

To stop Closure Lines of credit and you may And come up with Higher Dollars Deposits

You believe closure credit cards otherwise depositing a big amount of money would work on your side. But not, closing a personal line of credit instance a charge card your guessed it affects your credit rating. Even although you avoid the financing card, proof this can be acquired, and you also have not used it irresponsibly will benefit your.

Concurrently, a large, unusual cash put may look doubtful. It will take a lender to accomplish search to the whether or not the money was an advance loan provided with a pal or if perhaps the brand new unanticipated increase is additionally genuine.

personal loans no bank account required

End Modifying Your job

Quitting otherwise changing jobs may suggest a change in earnings. Having better otherwise even worse, the change commonly effect the mortgage software. Cut so it lifestyle change to own once you have signed with the mortgage, or at least, reach out to the lender to talk about how which change you may connect with the loan.

Avoid Other Big Financial Changes

Now’s maybe not the amount of time to improve banking institutions. In such a circumstance, the bank would need to decelerate the borrowed funds processes in order that they may be able collect one particular latest documents out of your the latest financial.

Keep the Financial Told out-of Unavoidable Lifetime Transform

For-instance, if you plan to find hitched when you look at the financial techniques, ensure that your bank understands. As to the reasons? Your wife would need to signal the loan, in the event they may not be an element of the financing.

If you plan in order to legally alter your term, its also wise to hold back until once you have signed to the mortgage. The latest difference inside labels for the some other files you will slow down the procedure.

Talk to the Lender or Representative

Whilst significantly more than seems like a lot, it comes to only to prevent any major monetary transform up to once you’ve finalized in your financing. If you find yourself not knowing, pose a question to your lender in advance of acting.